|

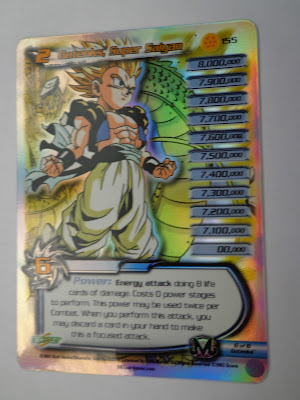

| DragonBall Z Gold Foil Cards |

There is a lot of investments out there being marketed out there nowadays. Gold and silver have been a hot hot topic nowadays since its price have been on a severe down-trend this year. It is much cheaper as compared to last year per say and this prompted a lot of people wanting to buy GOLD cheap in the hopes of selling it high later on when it goes on an up-trend again.

Heck, some financial gurus out there even shouted that they make money by shorting GOLD ETF indexes when it went downhill. These are the same bunch of people that was shouting buy buy buy like no tomorrow last few months ago. I guess they did not warn their readers about their 'EXIT' strategy. They just told you they make easy MONEY both ways aka when the price is up and when it tanked.

It is not like I blame them, but I pity those that follow them blindly without thinking and analysing things themselves. The proverb "give a man a fish and you feed him for a day. Teach a man to fish and you feed him for a lifetime" is always true to me. Armed yourselves with knowledge , that is why I named my blog to be www.knowthymoney.com. Because when I started this blog like 7-8 years ago, I am truly a newbie to the financial world. And now since I am getting older and hopefully wiser, I still don't know everything. But at least I know something :D

Okey, enough regressing.

Back to my topic of "Gold/Silver vs Stock vs Property Investment Thoughts":

I am still doubtful on gold and silver investments, either physical or paper investment types. Gold and silver investments are like my DragonBallZ gold foil cards, it can be priceless, but it cannot generate any income to me and its value is highly subjective to the purchaser.

For example, the DragonBallZ gold cards can trade like USD100 a pop on Ebay provided people go and buys it. (This makes me to wonder whether I have a few hundred of USD100s of gold foil cards lying around at my house drawer..Gotta check it out one of these days. Woot. My severely long term investments, which causes alot of angry naggings from my mom when I was a kid)

Hence I still like stocks (NOT unit trusts) and property investments. Stocks can provided healthy dividend returns to me while for property, my rentor is helping to pay for my property!

Speaking of dividend stocks, due to overwhelming response, do forgive me if I did not re-send out my newsletter on this matter . (See here for more details: In pursuit of dividend stocks in Malaysia).

Like what I mentioned I will only can do weekly periodic checking on that matter to resend you the list. So sign up ASAP by end of each week (I check it on Sunday) to avoid waiting for another week long. Btw, KCLI has broke the 1,800 barrier and this certainly is interesting event!!

Have a nice weekend!!

in my opinion, i think gold will continue to rise loh~

You need to understand in financial world there isnt a true or false, black or white facts. Sometime invest in gold is right, sometime invest in dividend stockmis right, sometime you should avoid klse, malaysia ppty and invest oversea. It is all down to how you manage your portfolio. If can try have your own business, dont over leverage.

I don't think gold will continue to rise but nonetheless, i have all the above three that you mention.

Diversify is the most important thing in investment. Do not put all your eggs in one basket.. If fall down all gone.

It depends on how much risk you can take.

Gold is higher risk than stock and see how it should fit into your investment portfolio.

Unless, someone said Gold is less risky than stock? Hmm...

@ChampDog

In my opinion, physical gold has higher risk due to low liquidity and wide buy/sell spread.

Besides gold is a commodity which can be very cyclic.

@KampungInvestor,

I don't hold any gold though.

I agree with you, Kris!